ccddgames.ru Community

Community

Td Bank Checking Account Fees

$5 monthly service fee, waived for the first year with a linked TD Bank checking account and a monthly transfer of at least $25, or $ minimum daily balance. Account holders can tend to get out of their monthly fees by opening both a checking and a savings account at the same bank or by maintaining a minimum balance. With our TD Convenience CheckingSM, you get a fully loaded checking account with just a $ minimum daily balance to avoid a monthly maintenance fee. We offer an overdraft service called TD Debit Card AdvanceSM with our personal checking accounts. Checks, ATM transactions, all other account fees (except. TD's accounts are already no-fee accounts if you maintain a minimum amount. Some of the other banks charge you fees no matter what amount you. Signature Savings accounts earn a higher rate when paired with a qualifying TD checking account. Cons. For the standard rates, a high balance is needed to. TD Complete Checking provides 3 ways to avoid the $15 monthly maintenance fee. · TD Beyond Checking provides 3 ways to avoid the $25 maintenance fee. · TD. Monthly Maintenance Fee. $25 ; Ways to Waive Monthly Fee. $1, combined minimum daily balance with one TD personal checking account ; No Charge Paid and/or. With our TD Convenience Checking SM, you get a fully loaded checking account with just a $ minimum daily balance to avoid a monthly maintenance fee. $5 monthly service fee, waived for the first year with a linked TD Bank checking account and a monthly transfer of at least $25, or $ minimum daily balance. Account holders can tend to get out of their monthly fees by opening both a checking and a savings account at the same bank or by maintaining a minimum balance. With our TD Convenience CheckingSM, you get a fully loaded checking account with just a $ minimum daily balance to avoid a monthly maintenance fee. We offer an overdraft service called TD Debit Card AdvanceSM with our personal checking accounts. Checks, ATM transactions, all other account fees (except. TD's accounts are already no-fee accounts if you maintain a minimum amount. Some of the other banks charge you fees no matter what amount you. Signature Savings accounts earn a higher rate when paired with a qualifying TD checking account. Cons. For the standard rates, a high balance is needed to. TD Complete Checking provides 3 ways to avoid the $15 monthly maintenance fee. · TD Beyond Checking provides 3 ways to avoid the $25 maintenance fee. · TD. Monthly Maintenance Fee. $25 ; Ways to Waive Monthly Fee. $1, combined minimum daily balance with one TD personal checking account ; No Charge Paid and/or. With our TD Convenience Checking SM, you get a fully loaded checking account with just a $ minimum daily balance to avoid a monthly maintenance fee.

The TD Bank savings account interest rate ranges from % to 4% APY depending on your balance and location. · The bank offers two savings account options with. The TD Signature Savings account charges a $15 monthly fee, which is waived if you maintain a $10, minimum daily balance or link an eligible TD Checking. TD Bank personal checking account to be eligible for this % discount. This relationship discount may be terminated and the interest rate on this account. Which bank charges the highest checking account fees? Of the top banks listed above, TD Convenience Checking has the highest monthly account fee at $ Monthly Maintenance Fee. $10 ; Ways to Waive Monthly Fee. N/A ; No Charge Paid and/or Deposited Items. ($ for each item thereafter) ; No Charge Cash. TD BANK BONUS CHECKING ACCOUNT - TD Bank Convenience Checking has a monthly maintenance fee. IDR penglihatan. H2: Fees and transaction limits of the TD Student Chequing Account · $0 to $4, · $5, and over. All other business checking product types will pay a $10 monthly service fee for TD Online Accounting. TD Business Convenience Checking Plus View the account. TD Basic Business Plan ; Monthly Plan Fee, CAD, 5 USD ; Additional Transaction fee, CAD each, USD. TD offers a monthly fee rebate on select Chequing Accounts if you maintain the minimum monthly balance or more for that account at the end of each day of the. The TD Signature Savings account charges a $15 monthly fee, which is waived if you maintain a $10, minimum daily balance or link an eligible TD Checking. TD Bank Beyond checking offers an APY of % (APY stands for annual percentage yield, rates may change). However, to earn interest account holders must keep. All other business checking product types will pay a $10 monthly service fee for TD Online Accounting. TD Business Convenience Checking Plus View the account. TD Beyond Checking has a monthly maintenance fee of $25 which can be waived by setting up direct deposits of $5, or more within a statement cycle. Free items paid and/or deposited, per statement cycle; additional items $ each. · Cash Deposited fee: $ per $ For deposits over $5, per. Signature Savings accounts earn a higher rate when paired with a qualifying TD checking account. Cons. For the standard rates, a high balance is needed to. If you ''Over Draft”, be prepared to pay a $ Overdraft Fee, that is what Most Banks are Charging. There are some exceptions, like if you. The TD Bank savings account interest rate ranges from % to 4% APY depending on your balance and location. · The bank offers two savings account options with. Account holders can tend to get out of their monthly fees by opening both a checking and a savings account at the same bank or by maintaining a minimum balance.

How To Sell Car You Are Financing

You essentially have three options of where you can sell a financed car: private sale, online retailer, or dealership. In most states, to sell your car to another person, dealership is a valid title to the vehicle and ID matching the title. You may also need a Vehicle History. How to Sell a Financed Car You Still Owe Money On · Gather information about your loan · Calculate your vehicle equity · Talk to your lender · Check your credit. Can You Trade in a Financed Car? Yes, you can trade in a financed car, but you still have to pay off the remaining loan balance. However, this is not as. You can trade a financed car at any point, but you may want to consider waiting a year or more. This is due to depreciation, which can see a new vehicle drop as. If you still owe money on your current ride, you could roll that negative equity onto the loan for your next car. You just want to make sure that the new. ccddgames.ru is equipped to handle all of your used car selling needs. Loan or no loan, we will buy your car and have you paid in about one hour. The dealer will purchase the car and pay off the loan, then they'll put what's left toward the new vehicle price, giving you a major advantage. If you have. The buyer gives you the money, you pay off the loan and then sign the title over to the buyer once it arrives. This works because possession is. You essentially have three options of where you can sell a financed car: private sale, online retailer, or dealership. In most states, to sell your car to another person, dealership is a valid title to the vehicle and ID matching the title. You may also need a Vehicle History. How to Sell a Financed Car You Still Owe Money On · Gather information about your loan · Calculate your vehicle equity · Talk to your lender · Check your credit. Can You Trade in a Financed Car? Yes, you can trade in a financed car, but you still have to pay off the remaining loan balance. However, this is not as. You can trade a financed car at any point, but you may want to consider waiting a year or more. This is due to depreciation, which can see a new vehicle drop as. If you still owe money on your current ride, you could roll that negative equity onto the loan for your next car. You just want to make sure that the new. ccddgames.ru is equipped to handle all of your used car selling needs. Loan or no loan, we will buy your car and have you paid in about one hour. The dealer will purchase the car and pay off the loan, then they'll put what's left toward the new vehicle price, giving you a major advantage. If you have. The buyer gives you the money, you pay off the loan and then sign the title over to the buyer once it arrives. This works because possession is.

Trading in a financed car is possible, but you still have to pay off the balance of the loan, which the trade-in price will often cover — and then some. If you have the cash, you'll save money on loan interest if you pay cash for the difference. Is trading in a financed car with negative equity a good idea? At Instant Finance, our car loans let your act like a cash buyer at a car yard, but it's important to remember that if you sell your car on, you still have a. Our process is tailored to you and your individual situation. · Our team will verify ownership, key details about the vehicle, and loan or lease information. How to Sell Your Car When You Still Have a Loan · Step One: Know What Your Car Is Worth · Step Two: Learn Your Payoff Amount · Step Three: Determine Your Equity. If you still owe money on the car, you won't have a clear title. As your lender what needs to be done to eliminate the loan and sell the car. Be sure to. You CAN sell your car even if it has an active lien on it, and it's actually not an uncommon process. But, it is a bit more complicated than not having a lien –. You CAN sell your car even if it has an active lien on it, and it's actually not an uncommon process. But, it is a bit more complicated than not having a lien –. However, some dealerships may be willing to roll over your remaining balance on your current vehicle into your new car loan. It works the same way if you want. Well, if the amount still owed on the vehicle is less than the vehicle's worth, the dealership will buy the vehicle and pay off the balance of the existing loan. The very first thing you need to do is find out the accurate amount you still owe on your car. The easiest way to do this is to call your lender and have them. Can you trade in a financed car? In most instances, yes, you can trade in a car with a loan, and some dealers might roll your remaining balance into a new loan. The most common way to sell a car under finance, while you're still making payments, is to first pay off the remaining debt. Steps for selling a car on finance; Step 1: Get a settlement letter; Step 2: Value your car; Step 3: Prepare your car; Step 4: Get an offer. Summary. Selling a car on finance is possible – and you even have several ways to do it. You can voluntarily terminate the contract, you can voluntarily return. To sell your car legally, you may need to release ownership of your vehicle by signing the title. You can then send the title to the buyer or the company that. This is probably the fastest way to sell the car, pay off the loan, remove the property lien from the title, and transfer ownership. This option is also the. How Does a Private Party Auto Loan Work? If the seller hasn't paid off their loan on the vehicle they're selling, your lender will first send the seller's. My guess is you will need to get the payoff amount and then send or wire them the money. You can pay the extra fee ($15 I think) to have the overnight you the. Most lenders won't have an issue with you selling your car while it's still under finance, but they will request that you pay off the balance of your loan once.

Top 10 Best Cash Back Credit Cards

American Express cards often come with top notch rewards and some of the most VIP perks packages available. It's also home to our #1 ranked credit card in. How do reward credit & debit cards work? · The five reward card need-to-knows · Top reward credit & debit cards. Chase: ongoing 1% cashback, NO FEE; NewAmex. + Show Summary · Wells Fargo Active Cash® Card · Blue Cash Everyday® Card from American Express · Discover it® Cash Back · Capital One SavorOne Cash. Rewards Program Details: 6% Cash Back at U.S. supermarkets on up to $6, per year in purchases (then 1%). 6% Cash Back on select U.S. streaming subscriptions. The no-annual-fee Capital One SavorOne offers great earning rates on food, travel and entertainment. 6 min read Jul 10, person. Our recommended cash-back credit cards. Best overall cash-back card: Chase Freedom Unlimited®; Best for cash-back on dining and groceries: Capital One SavorOne. Top 10 Cash Back Credit Card Offers – August · Rogers Red World Elite® Mastercard · Tangerine World Mastercard · Scotia Momentum® VISA Infinite* Card · Rogers. You can redeem cash back as a statement credit or a deposit to an external account. This card is also a good choice for balance transfers through October Tangerine cash back credit card and bank with them too. No fees. Good bank. American Express cards often come with top notch rewards and some of the most VIP perks packages available. It's also home to our #1 ranked credit card in. How do reward credit & debit cards work? · The five reward card need-to-knows · Top reward credit & debit cards. Chase: ongoing 1% cashback, NO FEE; NewAmex. + Show Summary · Wells Fargo Active Cash® Card · Blue Cash Everyday® Card from American Express · Discover it® Cash Back · Capital One SavorOne Cash. Rewards Program Details: 6% Cash Back at U.S. supermarkets on up to $6, per year in purchases (then 1%). 6% Cash Back on select U.S. streaming subscriptions. The no-annual-fee Capital One SavorOne offers great earning rates on food, travel and entertainment. 6 min read Jul 10, person. Our recommended cash-back credit cards. Best overall cash-back card: Chase Freedom Unlimited®; Best for cash-back on dining and groceries: Capital One SavorOne. Top 10 Cash Back Credit Card Offers – August · Rogers Red World Elite® Mastercard · Tangerine World Mastercard · Scotia Momentum® VISA Infinite* Card · Rogers. You can redeem cash back as a statement credit or a deposit to an external account. This card is also a good choice for balance transfers through October Tangerine cash back credit card and bank with them too. No fees. Good bank.

View top-ranked cash back credit card offers and earn more cash back. Compare bonus deals for and apply online. Cash back credit cards from Bank of America allow you to earn cash rewards on all of your purchases. Apply online. Best Cash Back Card With No Annual Fee—Chase Freedom Unlimited®. The Rogers Mastercard and Rogers Red World Elite Mastercard offer up to 3% cash back rewards with no annual fee. Wells Fargo Active Cash® Card: Best for Flat-rate cash back · Chase Freedom Unlimited®: Best for All-around cash back · Discover it® Cash Back: Best for Quarterly. Credit Card» Cashback · Standard Chartered Simply Cash Credit Card · RHB Shell Visa Credit Card · RHB Shell Visa Credit Card-i · RHB Cash Back Visa Credit Card. Whether you get a cash back or travel rewards credit card, you get the ability to capitalize on your spending. This is the case with the Blue Cash. Earn 10% cash back on all purchases for the first 3 months (up to $2, in total purchases). Plus, no annual fee in the first year, including on additional. Benefit Level. Visa Infinite®. Visa Signature® ; Credit score. Excellent. Good ; Features. Travel. Cash Back ; Provider. Amazon. Applied Bank. Best All Around Cash Back Card. Citi® Double Cash Card - 18 month BT offer. Learn More · Read. 15 Best cash back credit cards for September · + Show Summary · Wells Fargo Active Cash® Card · Blue Cash Everyday® Card from American Express. Your Cash Back Dollars never expire as long as your account is open and in good standing. Find the best TD Credit Cards for Cash Back in. Earn cash back on your purchases with an RBC cash back credit card. Choose the best card for you from our no fee and premium options. Apply today. Compare different types of cashback credit cards & companies to choose one that best fits your spending & lifestyle. Get a credit card that you will love! Cash Back Credit Cards ; Chase Freedom Unlimited credit card · NEW CARDMEMBER OFFER. Earn a $ bonus ; Chase Freedom Flex Credit Card · NEW CARDMEMBER OFFER. Earn. Get up to 10 cents off per litre at participating gas stations with Journie Rewards. Cash-back cards to carry while traveling abroad · Capital One Quicksilver Cash Rewards Credit Card · Deserve® Pro Mastercard. great features that come with your Freedom Unlimited® card; Keep tabs Prime Card Bonus: Earn 10% back or more on a rotating selection of items and. Cash back credit cards ; Capital One QuicksilverOne Cash Rewards Credit Card · reviews · % - 5% ; Capital One Quicksilver Cash Rewards Credit Card · great features that come with your Freedom Unlimited® card; Keep tabs Prime Card Bonus: Earn 10% back or more on a rotating selection of items and.

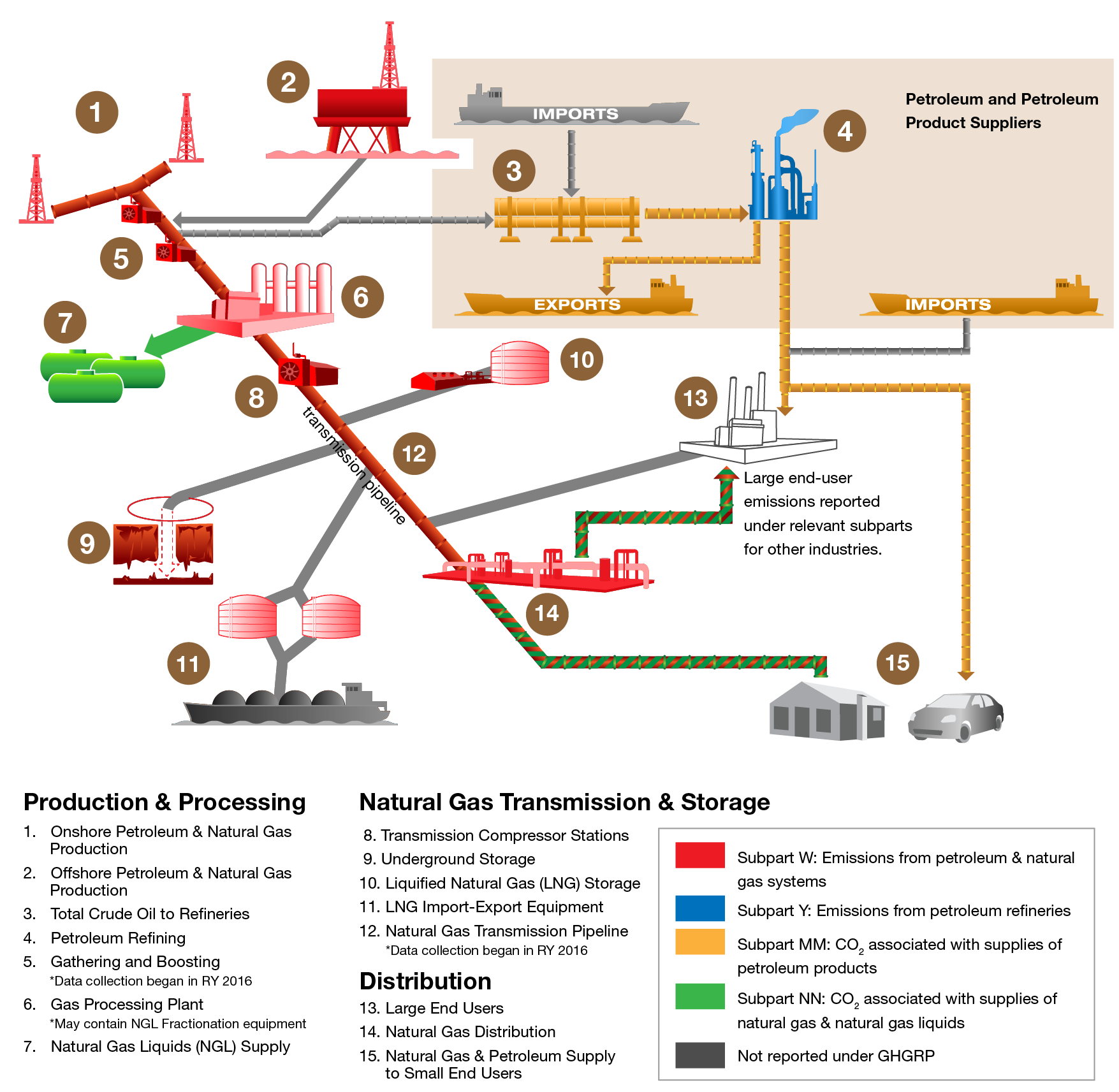

Extraction Oil And Gas Merger

The latest oil and gas news, dedicated to all things oil and gas: people Bonanza Creek and Extraction to Combine in Merger of Equals, Creating. Energy, Inc., Raptor Eagle Merger Sub, Inc. and Extraction Oil & Gas, Inc from Extraction Oil & Gas, Inc. filed with the Securities and Exchange Commission. Bonanza Creek and Extraction to Combine in Merger of Equals, Creating Civitas Resources - a New Colorado Energy Leader and the State's First. Energy, Inc., Raptor Eagle Merger Sub, Inc. and Extraction Oil & Gas, Inc from Extraction Oil & Gas, Inc. filed with the Securities and Exchange Commission. Bonanza Creek Energy, Inc. (NYSE: BCEI) entered into an agreement to acquire Extraction Oil & Gas, Inc. (NASDAQ:XOG) from Kimmeridge Energy Management. $ Million Crude Oil Midstream Acquisition and Dedication. JULY Extraction Oil & Gas, Inc. (NASDAQ: XOG). Over a period of ten months, the. Bonanza Creek Energy (USA): Merger with Extraction Oil and Gas (USA). Changes in Russell Equal Weight Index Series. 28 October Subject to the. $ Million Crude Oil Midstream Acquisition and Dedication. JULY Extraction Oil & Gas, Inc. (NASDAQ: XOG). Over a period of ten months, the. downstream (companies engaged in the business of refining petroleum after extraction). The oil and gas industry continued to see strong M&A activity through Q2. The latest oil and gas news, dedicated to all things oil and gas: people Bonanza Creek and Extraction to Combine in Merger of Equals, Creating. Energy, Inc., Raptor Eagle Merger Sub, Inc. and Extraction Oil & Gas, Inc from Extraction Oil & Gas, Inc. filed with the Securities and Exchange Commission. Bonanza Creek and Extraction to Combine in Merger of Equals, Creating Civitas Resources - a New Colorado Energy Leader and the State's First. Energy, Inc., Raptor Eagle Merger Sub, Inc. and Extraction Oil & Gas, Inc from Extraction Oil & Gas, Inc. filed with the Securities and Exchange Commission. Bonanza Creek Energy, Inc. (NYSE: BCEI) entered into an agreement to acquire Extraction Oil & Gas, Inc. (NASDAQ:XOG) from Kimmeridge Energy Management. $ Million Crude Oil Midstream Acquisition and Dedication. JULY Extraction Oil & Gas, Inc. (NASDAQ: XOG). Over a period of ten months, the. Bonanza Creek Energy (USA): Merger with Extraction Oil and Gas (USA). Changes in Russell Equal Weight Index Series. 28 October Subject to the. $ Million Crude Oil Midstream Acquisition and Dedication. JULY Extraction Oil & Gas, Inc. (NASDAQ: XOG). Over a period of ten months, the. downstream (companies engaged in the business of refining petroleum after extraction). The oil and gas industry continued to see strong M&A activity through Q2.

Search Oil, Gas & Consumable Fuels Merger Agreements business contracts filed with the Securities and Exchange Commission. This communication relates to merger transactions between BCEI and XOG (the "XOG Merger") and between BCEI, CPPIB Crestone Peak Resources America Inc. (". The company, which took its present name in per the merger of Exxon and Mobil, is vertically integrated across the entire oil and gas industry, and within. The combined company, to be named Civitas Resources, will be the largest pure-play energy producer in Colorado's Denver-Julesburg Basin. In connection with the execution of the Extraction merger agreement, Kimmeridge Energy Extraction special meeting”) of Extraction Oil & Gas, Inc. (“Extraction. Bonanza Creek and Extraction to Combine in Merger of Equals, Creating Civitas Resources - a New Colorado Energy Leader and the State's First. merge Chevron's natural gas and natural gas liquids business with NGC. On May 23, , the companies reached an agreement in principle to merge their business. - Mining, Quarrying, Oil & Gas Extraction - Oil and Gas Extraction - Crude Oil and Natural Gas Extraction MERGER: MERGING HUSKY OIL COMPANY WITH. - Mining, Quarrying, Oil & Gas Extraction - Oil and Gas Extraction - Crude Oil and Natural Gas Extraction MERGER: MERGING POWER GAS MARKETING. SEC filings and transcripts for Extraction Oil & Gas Inc, including financials, news, proxies, indentures, prospectuses, and credit agreements. - Mining, Quarrying, Oil & Gas Extraction - Oil and Gas Extraction - Crude Oil and Natural Gas Extraction MERGER: MERGING HUSKY OIL COMPANY WITH. The latest oil and gas news, dedicated to all things oil and gas: people Bonanza Creek and Extraction to Combine in Merger of Equals, Creating. As of August Extraction Oil & Gas has a market cap of $ Billion. This makes Extraction Oil & Gas the world's th most valuable company according. See discussion above for the treatment of the merger with Extraction Oil & Gas, Inc. Cabot Oil & Gas Corporation changed its name to Coterra. Energy Inc. Shell was formed in April through the merger of Royal Dutch Petroleum Company of the Netherlands and The "Shell" Transport and Trading Company of the. Bonanza Creek Energy (USA): Merger with Extraction Oil and Gas (USA). Changes in Russell Equal Weight Index Series. 28 October Subject to the. SEC filings and transcripts for Extraction Oil & Gas Inc, including financials, news, proxies, indentures, prospectuses, and credit agreements. Mid-West Oil was incorporated in Alberta in , formed by the merger of Northwestern Pacific Oil Company and Western Pacific Oil Company. Mid-West was. Extraction Oil & Gas, Inc. (XOG), Create: Alert "Bonanza Creek and extraction announce closing of Merger and subsequent acquisitIon of crestone peak". NGL extraction and fractionation; Shale gas and oil sands joint ventures in its indirect acquisition of Kicking Horse Oil & Gas Ltd., a portfolio.

Cost Of A Pop Up Shop

Rental Fees: the cost is $45/day plus HST for unit rental and third-party insurance under the City of Cornwall policy. If you provide us with your existing. Pop-Up Shops at Martin Street is a pop-up retail store program in Downtown Raleigh at 17 E Martin Street. fee to cover common utilities. Rent and CAM fee. 1. Fixed Costs. Fixed costs can include everything from rental fees and liability insurance to utilities and WiFi. These are the essentials to keep your shop. Drawbacks of pop-up stores · Cost. Although the pop-up model is cheap compared to operating a traditional storefront, and has less fixed costs, it is still a. A guide on how much it costs to set up a pop-up shop. Includes estimates on pricing and a bunch of tips and trick to consider. Pop-Up Shop Program | Doing Business | Downtown Green Bay. business owners through no-cost, confidential consulting and targeted educational programs. The cost to set up a pop-up shop varies significantly. It could cost as low as $5, or less or up to $25, or more, depending on the type of shop you open. Rent: The cost of renting a space for your pop-up shop will depend on the location and size of the space. This can range from a few hundred to. Breakdown of Typical Costs · 1. Rental Costs. Prime Locations: $3, - $8, per day. Secondary Locations: $1, - $3, per day · 2. Fit-Out and Design. Rental Fees: the cost is $45/day plus HST for unit rental and third-party insurance under the City of Cornwall policy. If you provide us with your existing. Pop-Up Shops at Martin Street is a pop-up retail store program in Downtown Raleigh at 17 E Martin Street. fee to cover common utilities. Rent and CAM fee. 1. Fixed Costs. Fixed costs can include everything from rental fees and liability insurance to utilities and WiFi. These are the essentials to keep your shop. Drawbacks of pop-up stores · Cost. Although the pop-up model is cheap compared to operating a traditional storefront, and has less fixed costs, it is still a. A guide on how much it costs to set up a pop-up shop. Includes estimates on pricing and a bunch of tips and trick to consider. Pop-Up Shop Program | Doing Business | Downtown Green Bay. business owners through no-cost, confidential consulting and targeted educational programs. The cost to set up a pop-up shop varies significantly. It could cost as low as $5, or less or up to $25, or more, depending on the type of shop you open. Rent: The cost of renting a space for your pop-up shop will depend on the location and size of the space. This can range from a few hundred to. Breakdown of Typical Costs · 1. Rental Costs. Prime Locations: $3, - $8, per day. Secondary Locations: $1, - $3, per day · 2. Fit-Out and Design.

Vendor fee varies depending on the event that is being held. Normally our prices range between $ as listed below. (Unless there is a special or discount. Thanks to Storefront, you can now find the pop-up store rental in just three clicks. Lofts, retail spaces, apartments, malls, you'll find a wide range of pop-up. The cost varies depending on brand association, footfall levels, store size and location. Retailers also deduct a percentage of sales from pop-up shop. Most booth fees average at around $ This fee covers space only and boutique owners must provide their own tent, table, chairs as well as method of payment. Generally speaking, a small pop-up shop in an affordable area for a single month could cost around $2,$5,, depending on these factors. But you may have. This can range from a few hundred to several thousand dollars per month. Insurance: You'll need to purchase insurance for your pop-up shop. Vendor fee varies depending on the event that is being held. Normally our prices range between $ as listed below. (Unless there is a special or discount. The starting price for a mobile pop-up shop is around $15, This includes wrapping and transporting the vehicle. Other factors such as permits, location. It costs $25, to $50, to get most mobile popup shop vehicles branded and built for your activation needs, and then, depending upon permits, staffing. Pop-up stores can be low-cost, low-risk initiatives that have the potential to have a huge impact on your brand and business. It's hard to give an estimate for the overall cost to set up a pop-up shop in California, but it can range from a few thousand to tens of thousands of dollars. Pop-up shops can be a fantastic way to get your products in front of customers, spread awareness, and make extra sales. Discover the average cost of hosting a pop-up store in New York. Learn about prime locations, rental rates, and budgeting tips for a successful pop-up shop. Learn the startup costs for a pop-up shop. Our guide helps you budget and plan for a successful launch and profitable sales. On average, prices range from $60 to $ per hour. The cost of renting a pop-up shop in New York City varies widely depending on the location, size, and. ?' One of the most common questions we get asked by brands interested in this space is 'So, how much does a Pop-Up shop cost. How a Branded Mobile Pop-Up Shop Works · Know who you're trying to reach. · Next, you'll want to pick the right location(s). · Build or rent the right footprint. Note: Licensed Shared Kitchen Users and Retail Food Establishments may add the business activity of Pop-Up User without any fees. Are the Pop-Up User. Pop-up shops are no longer just a trend: The pop-up industry has grown to reach an estimated market size of $14 billion, and brands ranging from Nordstrom to. Pop-up retail is a retail store (a "pop-up shop Congestion pricing is a dynamic pricing strategy that attempts to regulate demand by increasing prices without.

Credit Cards You Can Get With 600 Credit Score

Whether you're a student just starting to establish credit or you need to rebuild credit, we have credit cards that are designed to help build or rebuild your. Here's why: Capital One advertises that this card is intended for people with fair credit, which can help make the application process less stressful if you. The Platinum Mastercard® from Capital One is an unsecured card you can get with a credit score that charges no annual fee. It doesn't offer rewards and the. Why do your scores matter? Credit scores affect whether you can get credit and what you pay for credit cards, auto loans, mortgages and other kinds of credit. While it's possible to get a Discover card with a credit score around for Discover card approval, it may limit your options. You may be more likely to. The average credit score is and most Americans have scores between and , with + considered to be good. Find out more on how you compare. Credit cards for those with a credit score With this range, you can get some access to cards (including no-fee cards or student credit cards) but you will. Our top choices for a new credit card if you have a credit score are the Petal 2 Visa and Capital One QuicksilverOne because they're easy to use and earn. The average credit score is and most Americans have scores between and , with + considered to be good. Find out more on how you compare. Whether you're a student just starting to establish credit or you need to rebuild credit, we have credit cards that are designed to help build or rebuild your. Here's why: Capital One advertises that this card is intended for people with fair credit, which can help make the application process less stressful if you. The Platinum Mastercard® from Capital One is an unsecured card you can get with a credit score that charges no annual fee. It doesn't offer rewards and the. Why do your scores matter? Credit scores affect whether you can get credit and what you pay for credit cards, auto loans, mortgages and other kinds of credit. While it's possible to get a Discover card with a credit score around for Discover card approval, it may limit your options. You may be more likely to. The average credit score is and most Americans have scores between and , with + considered to be good. Find out more on how you compare. Credit cards for those with a credit score With this range, you can get some access to cards (including no-fee cards or student credit cards) but you will. Our top choices for a new credit card if you have a credit score are the Petal 2 Visa and Capital One QuicksilverOne because they're easy to use and earn. The average credit score is and most Americans have scores between and , with + considered to be good. Find out more on how you compare.

You can ask a friend or family member to add you as an authorized user on their credit card. Just make sure that the credit card company reports authorized. With a credit score, you might be able to get a traditional credit card. While most credit card issuers don't publish minimum credit scoring standards, some. credit card payments but rather “have you paid off a car before? get away with are revolving credit accounts like credit cards and. Visa Credit Cards · Amazon · Applied Bank · BILL Spend & Expense · Capital Bank · Capital One · Celtic Bank · Chase · Chime. Capital One credit cards for fair credit include QuicksilverOne, Quicksilver Secured, and the Platinum Mastercard. Your credit score is only one of the many. Acorn Finance gives you access to dozens of fully vetted lenders. We all try our best, but we all can't have excellent credit scores. Life events like divorce. If you have fair credit, the Capital One Platinum card is our top pick due to its limited fees, ability to increase your credit limit and more. Why the Capital One QuicksilverOne Cash Rewards Credit Card is a good option for those with fair credit. You'll get an automatic credit line review after just. Yes, you can get a credit card with a credit score. What credit limit can I get with a score? In most cases, you won't know the exact credit limit you'd. Yes, you can get a personal loan with a credit score — there are even lenders that specialize in offering fair credit personal loans. But keep in mind that. There are several unsecured cards you can get with a credit score, the best of which is the Credit One Bank® Platinum Visa® for Rebuilding Credit. This card. What types of credit cards can you get with a credit score? · Discover it® Secured Credit Card · Petal® 2 “Cash Back, No Fees” Visa® Credit Card · Capital One. With a credit score, you're probably eligible for several credit card options designed to foster credit growth. The main cards are secured credit cards. How. People with a credit score – credit card with no credit check to apply · No annual fee or interest¹ · No credit check to apply · No minimum security deposit. It indicates that the person may have had some difficulties in maintaining a good credit history, possibly missing payments or carrying high amounts of debt. Can You Get a Credit Card for a Credit Score? Yes, you can! While a score of may limit your choices, there are still several credit. If you have a FICO score, you're considered a fair credit borrower. About % of Americans are in the same boat, according to Experian. A fair credit. A secured card would likely be your best option right now. These days, there are quite a few that offer rewards of some sort. Look into Discover. A credit score is considered "fair" by most lenders. This means that while you're not in the danger zone, you're also not in the safe zone. Instead, you'll have to choose credit cards with a lower credit limit or that charge annual fees and high-interest rates. Lenders use your credit score to.

Referral Quotes For Business Cards

"When you empower your customers to refer, you empower your business to thrive." - Referral marketing isn't passive; it's proactive. By creating a referral-. referral sources instantly draw conclusions about your business when they see your business card. Or call () to get quotes from a Brazzell. “Your referrals are the sweetest part of my business.” “Coffee and your referrals keep my business going.” “Fishing for your referrals! Know anyone looking to. cards! Refer a friend now business may be looking for a quick and easy way to purchase business insurance. company and earn a $20 gift card if the referred-in friend gets a quote. The refer can only earn one reward but for every referral quote, Reata will donates. Business Insurance. Business Insurance · Business For qualified referrals you provide that receive preferred quotations you receive a $10 Gift Card. Below you'll find ten excellent referral thank you letter samples that will help you say, "Thank you for the referral!" Use these to create your own! Let us help you create your referral cards with absolutely everything customised for your business at an affordable price. Get a quote now. Editable We'd Be Thrilled To Pieces To Earn Your Business Printable Tag Realtor Client Appreciation Referral Gift T (Digital file only). "When you empower your customers to refer, you empower your business to thrive." - Referral marketing isn't passive; it's proactive. By creating a referral-. referral sources instantly draw conclusions about your business when they see your business card. Or call () to get quotes from a Brazzell. “Your referrals are the sweetest part of my business.” “Coffee and your referrals keep my business going.” “Fishing for your referrals! Know anyone looking to. cards! Refer a friend now business may be looking for a quick and easy way to purchase business insurance. company and earn a $20 gift card if the referred-in friend gets a quote. The refer can only earn one reward but for every referral quote, Reata will donates. Business Insurance. Business Insurance · Business For qualified referrals you provide that receive preferred quotations you receive a $10 Gift Card. Below you'll find ten excellent referral thank you letter samples that will help you say, "Thank you for the referral!" Use these to create your own! Let us help you create your referral cards with absolutely everything customised for your business at an affordable price. Get a quote now. Editable We'd Be Thrilled To Pieces To Earn Your Business Printable Tag Realtor Client Appreciation Referral Gift T (Digital file only).

If you require a sheet count other than what is shown, please contact us at for a custom quote. Custom Business Cards. Order. business cards you may be handing off to your clients and leads. On that quote all the extra business. With an easy-to-use interface, beautiful. We love referrals get up to $25 gift card for your Auto Insurance referrals, Free sales person business cards and much more. Florida auto salesperson free. We appreciate your business and we love referrals from our clients! The For each referral you make, not only do you get the $10 gift card to QT. SmartPractice Veterinary Referral Business Cards are the easy way to spread your name. Get free personalization on Vet Referral Business Cards. It's essential to have systems and strategies to encourage clients to provide referrals, such as posting online reviews, using printed referral cards, or making. Business Cards · Flyers & Brochures · Announcement Cards · Envelopes · Letterhead Task tracker. *note due to supply chain difficulties, we cannot guarantee. It's the highest compliment you can give us and as a thank you, we'll send you a $ e-gift card of choice for each referral. Take a look! How Do I Refer. Custom rewards, gift cards, cash cards, and more. Custom Rewards referral program and grow your business. Read More. Consumers Trust Friends. card valid at Kwik Trip In order to be eligible for your reward, your referee needs to get a free, no-obligation comparison quote for their home, auto, or. Full-color Vet Referral Business Card features a colorful bulletin board pinned with pet photos and your practice information. for $ - $ each. We. From a bank, credit card company, prepaid debit, cell phone, Internet connection, Social Security, the IRS, I mean anybody. you immediately go. Business Cards; Premium Business Cards Custom Quotes · Promotional Products · Paper Sample Books · Print & Coating. I couldn't keep in touch with my business clients, friends, and family. My business partner introduced me to the Send Out Cards Referral System as a business. You will not have your business blow up, air quotes using Doug's words, or the referral explosion that I have seen people have just by sending thank you cards. The Leading Real Estate Referral & License Holding Company Quotes: Below is a couple of quote ideas that you can use on the front of your business cards. Thank you cards are always appreciated! Let your patients know how much you value their high opinion and referrals by sending a personalized message. However, it's critical that you express your appreciation to those who help you find business through referrals by saying, “thank you for the referral.” While. Choose from business checking, business credit cards, merchant services or visit our business resource center. Investing by J.P. Morgan. Whether you choose. In addition to serving as a Rewards Card, Referral Cards help add qualified buyers to your customer base. Referral cards can only be used by new customers.

Is Robinhood A Good Stock App

Robinhood has become a popular stock trading app and is responsible for giving a new generation of investors access to the stock market. Robinhood doesn't charge you an FX fee for your trades. We hold your funds in USD, so when funding or withdrawing, a % third party cost will be included in. Robinhood is a good investment platform for young investors or those with limited experience in the stock market: Ease of Use: Robinhood is. The app offers a lot of free features to keep those users engaged. Robinhood analysts make predictions: buy, hold or sell for many of the stocks. The modern market of Robinhood-like apps is driven by users that want to invest with little money. Today, each person can download a stock advisor app and start. Originally a mobile app, they allow anyone, especially young people, to invest in the stock market. Robinhood is completely free to use; there are no trading. Robinhood makes it easy to trade stocks, ETFs, options, and crypto, but account types, tools, and research are limited in an increasingly competitive space. And we would agree that the Robinhood app is just as sleek and user-friendly as the website. If you haven't had a chance to sign up for an account yet, you can. Robinhood has a very simple UI which makes it good for beginner traders. If you're looking to use this tool for scalping, momentum trading, or day trading. Robinhood has become a popular stock trading app and is responsible for giving a new generation of investors access to the stock market. Robinhood doesn't charge you an FX fee for your trades. We hold your funds in USD, so when funding or withdrawing, a % third party cost will be included in. Robinhood is a good investment platform for young investors or those with limited experience in the stock market: Ease of Use: Robinhood is. The app offers a lot of free features to keep those users engaged. Robinhood analysts make predictions: buy, hold or sell for many of the stocks. The modern market of Robinhood-like apps is driven by users that want to invest with little money. Today, each person can download a stock advisor app and start. Originally a mobile app, they allow anyone, especially young people, to invest in the stock market. Robinhood is completely free to use; there are no trading. Robinhood makes it easy to trade stocks, ETFs, options, and crypto, but account types, tools, and research are limited in an increasingly competitive space. And we would agree that the Robinhood app is just as sleek and user-friendly as the website. If you haven't had a chance to sign up for an account yet, you can. Robinhood has a very simple UI which makes it good for beginner traders. If you're looking to use this tool for scalping, momentum trading, or day trading.

But rather than just 'looking,' Robin Hood has a team of whitehat hackers constantly trying to break through its defenses. That way, Robinhood can stay one step. I particularly like how sleek and user-friendly Robinhood's mobile app is, plus all of the features it offers investors (including crypto, high-yield accounts. Deciding how to invest money, including in stocks such as Robinhood, is an extremely personal choice. It's a good idea to evaluate the stock to see if you feel. Robinhood was founded by two former Stanford students back in The app's goal was to “provide everyone with access to the stock market, not. Robinhood has commission-free investing, and tools to help shape your financial future. Sign up and get your first stock free. Limitations and fees may. The Robinhood app is totally safe, totally legit, and used by over 18 million people. Robinhood is easy to use, and you only need $10 to open an account. Lastly, Robinhood doesn't allow short selling. This means you can't short stocks, profit as they go lower, and then buy back shares at a lower price. Not. Originally a mobile app, they allow anyone, especially young people, to invest in the stock market. Robinhood is completely free to use; there are no trading. You and your friend both get to pick your own stock of America's leading companies if you have the correlated promotional screen in your Robinhood account. Robinhood is considered safe for investors. It's a member for the Securities Investor Protection Corp. (SIPC), is regulated by the SEC, and has additional. Robinhood is a great broker if you're looking for cheap, no-nonsense US stock and ETF trading on the go. Robinhood is an intuitive trading app where you can trade stocks, options How we rate trading platforms. 5/5 — Excellent. 4/5 — Good. With no commissions and no minimum deposit required, Robinhood is one of the best apps for new investors to begin trading stocks, crypto, ETFs. Join the people who've already reviewed Robinhood. Your experience can help others make better choices Download the Trustpilot iOS app. Community. With Robinhood you can place trades on Nasdaq and the NYSE without having to pay to move your money around. In addition to being cost-effective, the app is. With no commissions and no minimum deposit required, Robinhood is one of the best apps for new investors to begin trading stocks, crypto, ETFs. My top 3 Robinhood penny stocks to buy now (as long as their price action is strong) are Serve Robotics Inc (NASDAQ: SERV), Mira Pharmaceuticals Inc (NASDAQ. Robinhood is the pioneer of commission-free stock trading. DIY investors who want hassle-free trades love the app. The Robinhood app is totally safe, totally legit, and used by over 18 million people. Robinhood is easy to use, and you only need $10 to open an account.

How To Get Juris Doctor Law Degree

Our full-time JD degree program is designed for students who have the capacity to devote themselves full-time to the study of law. Typically, this program. Getting a JD from an accredited university in the USA opens up a world of possibilities for those wanting to become lawyers. You can specialize in an area of. It takes about three years for most. You cannot receive a Juris Doctor (other than through an honorarium JD) without going to law school. Generally, the required course load for the first year is 15 assigned credits in the fall and spring semesters. Several focused programs can enhance JD students. La Verne Law offers an affordable, flexible Juris Doctor (JD) degree program with full and part-time options in Southern California. Find out more now. You also have access to resources, programming and dedicated staff that will help you throughout your law school journey. What sets the USC Gould JD program. The credential for becoming a lawyer is the Juris Doctor (J.D.). The J.D. requires a rigorous course of study in a competitive environment for three years. "I applied to Arizona Law because I was impressed with its reputation for helping graduates find jobs that actually require a JD, and because it has a fantastic. To earn a Juris Doctor (J.D.) degree from the University of Washington School of Law, a student must meet the residence requirements and must complete at least. Our full-time JD degree program is designed for students who have the capacity to devote themselves full-time to the study of law. Typically, this program. Getting a JD from an accredited university in the USA opens up a world of possibilities for those wanting to become lawyers. You can specialize in an area of. It takes about three years for most. You cannot receive a Juris Doctor (other than through an honorarium JD) without going to law school. Generally, the required course load for the first year is 15 assigned credits in the fall and spring semesters. Several focused programs can enhance JD students. La Verne Law offers an affordable, flexible Juris Doctor (JD) degree program with full and part-time options in Southern California. Find out more now. You also have access to resources, programming and dedicated staff that will help you throughout your law school journey. What sets the USC Gould JD program. The credential for becoming a lawyer is the Juris Doctor (J.D.). The J.D. requires a rigorous course of study in a competitive environment for three years. "I applied to Arizona Law because I was impressed with its reputation for helping graduates find jobs that actually require a JD, and because it has a fantastic. To earn a Juris Doctor (J.D.) degree from the University of Washington School of Law, a student must meet the residence requirements and must complete at least.

Juris Doctor Requirements · 90 Law Credits (48 credits in required courses; 42 credits in elective offerings) · Minimum cumulative grade point average of First-year Juris Doctor students take courses in civil procedure, contracts, torts, legal method and writing, property, constitutional law, criminal law, legal. Juris Doctor Application Process · Application: Apply online via Law School Admission Council (LSAC). · Application Fee: · Transcripts: · LSAT Scores: · Letters of. The online JD program requires 80 units (85 for students matriculation Fall ), including core and elective offerings. Flexible options allow you to complete. Earn a juris doctor degree with the state-accredited online program at Purdue Global Law School. This program prepares you for the California Bar Exam. In many states, you won't qualify to take the bar exam without first getting your JD. The coursework provides the knowledge needed to pass the bar exam, and you. A Juris Doctor, JD for short, is a professional law degree and academic credential conferred by law schools upon graduation. This graduate degree enables you to. M programs do not require candidates to take the LSAT in order to apply; however, a first degree in law, such as, but not limited to, a JD, is required for. The Juris Doctor (J.D.) is a professional degree and the first degree required to practice law in the United States. At Temple, students can earn a J.D. in. To graduate with a Juris Doctor degree, you must successfully complete 74 units of required courses and 16 units of electives (90 units total) with C average . You can graduate from any law school and their basic degree is the Juris Doctor or J.D. degree. You then must pass a State Bar exam (or. I. Requirements for the juris doctor (J.D.) degree · complete 86 credit hours and must earn a cumulative GPA of or higher on all credit hours completed; and. The three-year Juris Doctor degree curriculum gives you a solid foundation in legal analysis, critical thinking, and practical lawyering skills to become an. The Residential Three-Year JD Program is the JD track most students choose when entering law school. Students in this program complete their studies over the. In the second and third years, you have the opportunity to design a course of study that fits your aspirations. In part this means choosing courses on the. law. Your J.D. academic experience at Columbia Law School is powered by connections that go far beyond the classroom. Connect your studies to your practice. JD Program Requirements · have a completed bachelor's degree from an accredited college or university; · register with the Law School Admission Council (LSAC). Students may combine their J.D. with an LL.M.; a degree in business, public health, public policy, government, philosophy; or one of many offered by the School. General Requirements · Earn credit for at least 90 semester hours of law study · Obtain an overall GPA of or better, and · Earn a minimum of 3 clinical and/or. The JD degree is conferred on a student who has completed 90 semester hours of course credit as prescribed by the faculty, with a minimum overall grade point.

How Much Do I Need To Get A Mortgage

You need to consider your own circumstances and your future financial needs and goals. What do lenders look at when deciding whether or not to finance a. 3% or more of purchase price How much should I put down? popup. Down payment Do I need to get a home appraisal in order to get a home loan? How long. The general rule of thumb is 20% but that is a scary number to 99% of the people so there are now retail products that let you borrow on 5% or less. Down payment. This is the amount you pay upfront toward your home purchase. Typically, the recommended amount is 20% of your purchase price. Under certain loan. The 28% mortgage rule states that you should spend 28% or less of your monthly gross income on your mortgage payment (eg, principal, interest, taxes and. Find out how much you can afford with our mortgage affordability calculator. See estimated annual property taxes, homeowners insurance, and mortgage. A general guideline for the mortgage you can afford is % to % of your gross annual income. However, the specific amount you can afford to borrow depends. The mortgage you could afford depends on many factors, including your total monthly payment, income, debt obligations, creditworthiness, down payment amount and. A minimum 5% down payment · A minimum credit score for a two-unit home · A minimum credit score for a three- to four-unit home · A DTI ratio of 36% or less. You need to consider your own circumstances and your future financial needs and goals. What do lenders look at when deciding whether or not to finance a. 3% or more of purchase price How much should I put down? popup. Down payment Do I need to get a home appraisal in order to get a home loan? How long. The general rule of thumb is 20% but that is a scary number to 99% of the people so there are now retail products that let you borrow on 5% or less. Down payment. This is the amount you pay upfront toward your home purchase. Typically, the recommended amount is 20% of your purchase price. Under certain loan. The 28% mortgage rule states that you should spend 28% or less of your monthly gross income on your mortgage payment (eg, principal, interest, taxes and. Find out how much you can afford with our mortgage affordability calculator. See estimated annual property taxes, homeowners insurance, and mortgage. A general guideline for the mortgage you can afford is % to % of your gross annual income. However, the specific amount you can afford to borrow depends. The mortgage you could afford depends on many factors, including your total monthly payment, income, debt obligations, creditworthiness, down payment amount and. A minimum 5% down payment · A minimum credit score for a two-unit home · A minimum credit score for a three- to four-unit home · A DTI ratio of 36% or less.

The money you're borrowing from the bank (which is your mortgage) will need to be repaid with interest and in exchange, you'll get to occupy the home and. Top home mortgage FAQs · How does my credit rating affect my home loan interest rate? · Do I need to get a home appraisal in order to get a home loan? · How long. If you're just starting out, you can establish a credit history good enough to qualify for a mortgage within two years. This requires that you have a mix of. Not sure how much mortgage you can afford? Use the calculator to discover For down payments of less than 20%, home buyers are required to purchase mortgage. With a year mortgage, your monthly income should be at least $ and your monthly payments on existing debt should not exceed $ (This is an estimated. A general guideline for the mortgage you can afford is % to % of your gross annual income. However, the specific amount you can afford to borrow depends. Required Annual Income: This does not include upfront mortgage insurance if needed. Your salary must meet the following two conditions on FHA loans: - The. The most you can borrow is usually capped at four-and-a-half times your annual income. It's tempting to get a mortgage for as much as possible but take a. Lenders will look at your salary when determining how much house you can qualify for, but you'll need to look at the big picture — your actual take-home pay and. How much house can I afford? · Learn the difference between a mortgage prequalification and mortgage preapproval. · This narrated video helps explain what you can. Your debt-to-income ratio (DTI) would be 36%, meaning 36% of your pretax income would go toward mortgage and other debts. This DTI is in the affordable range. You typically need a minimum deposit of 5% to get a mortgage. Please increase the deposit amount to use the calculator. Find out more about the fees you may. Your debt-to-income ratio (DTI) would be 36%, meaning 36% of your pretax income would go toward mortgage and other debts. This DTI is in the affordable range. One way to start is to get pre-approved by a lender, who will look at factors such as your income, debt and credit, as well as how much you have saved for a. How much house you can afford is also dependent on the interest rate you get, because a lower interest rate could significantly lower your monthly mortgage. What is your desired location? Your location will be used to find available mortgages and calculate taxes. need a mortgage of about $, In Ann. You can afford a home worth up to $, with a total monthly payment of $1, ; LOAN & BORROWER INFO. Calculate affordability by · Annual gross income · Must. To purchase a $1 million home, typically, an annual income of at least $, is required. However, this requirement can vary based on several other factors. Mortgage lenders base their decisions on what's known as the loan-to-income ratio – the amount you want to borrow divided by how much you earn. To determine how much you can afford for your monthly mortgage payment, just multiply your annual salary by and divide the total by This will give.